CHANGE IN ACCOUNTING POLICY

In fiscal 2022, there were no significant changes in the previously adopted accounting policies or their application.

FINANCIAL POSITION

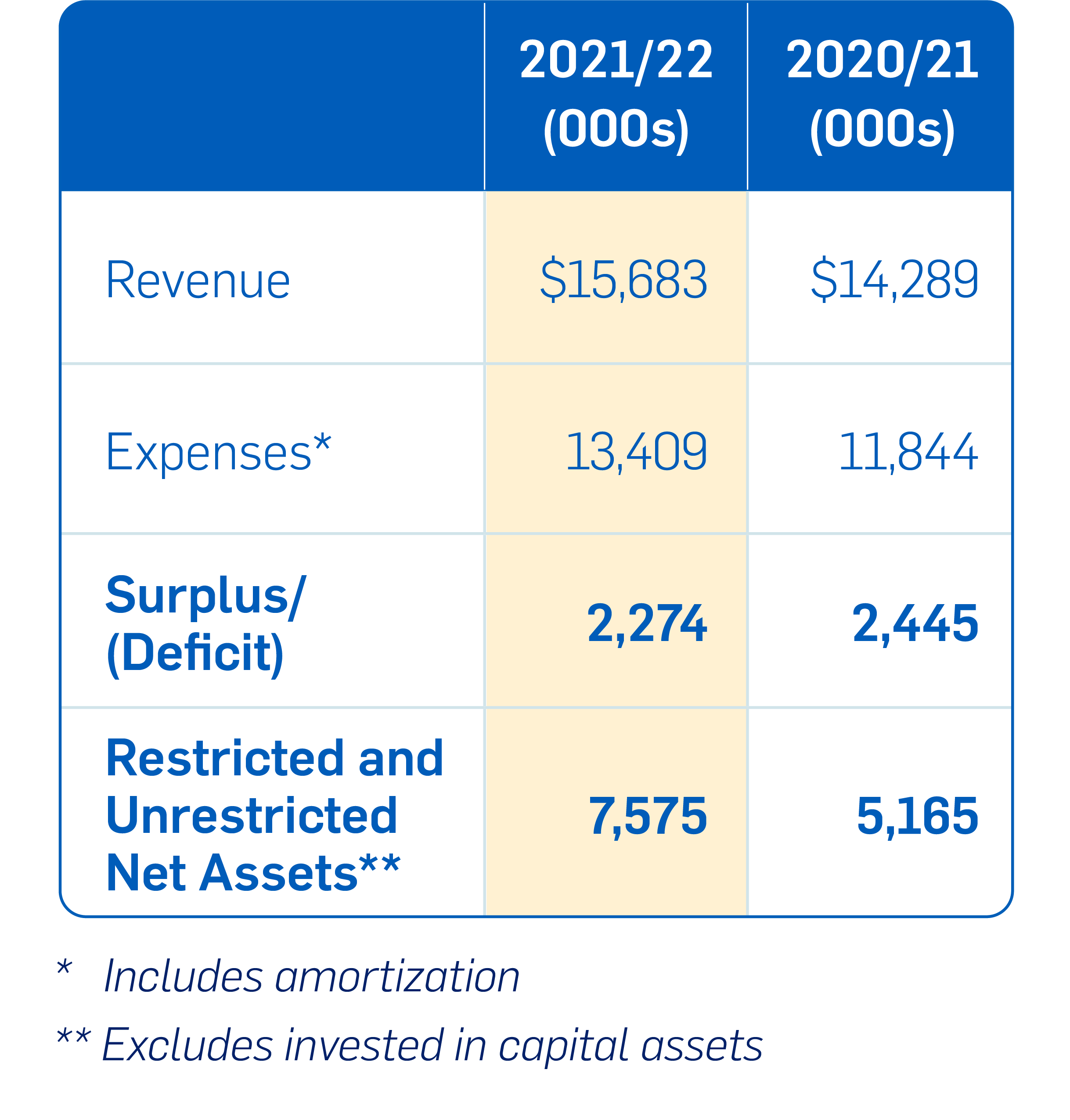

At March 31, 2022, FP Canada’s net assets are $8.3 million, compared to $6 million in 2021. Internally restricted and unrestricted net assets (“available reserves”) are $7.6 million, compared to $5.2 million in 2021. Current available reserves account for six months in operating expenses.

FP Canada’s cash, cash equivalents and investments total $19.5 million at March 31, 2022, compared to $17.1 million in 2020. Investments are managed in accordance with Board approved investment policies.

RESULTS FROM OPERATIONS

FP Canada’s excess of income over expenses is $2.3 million for the year ended March 31, 2022, compared to $2.4 million in 2021.

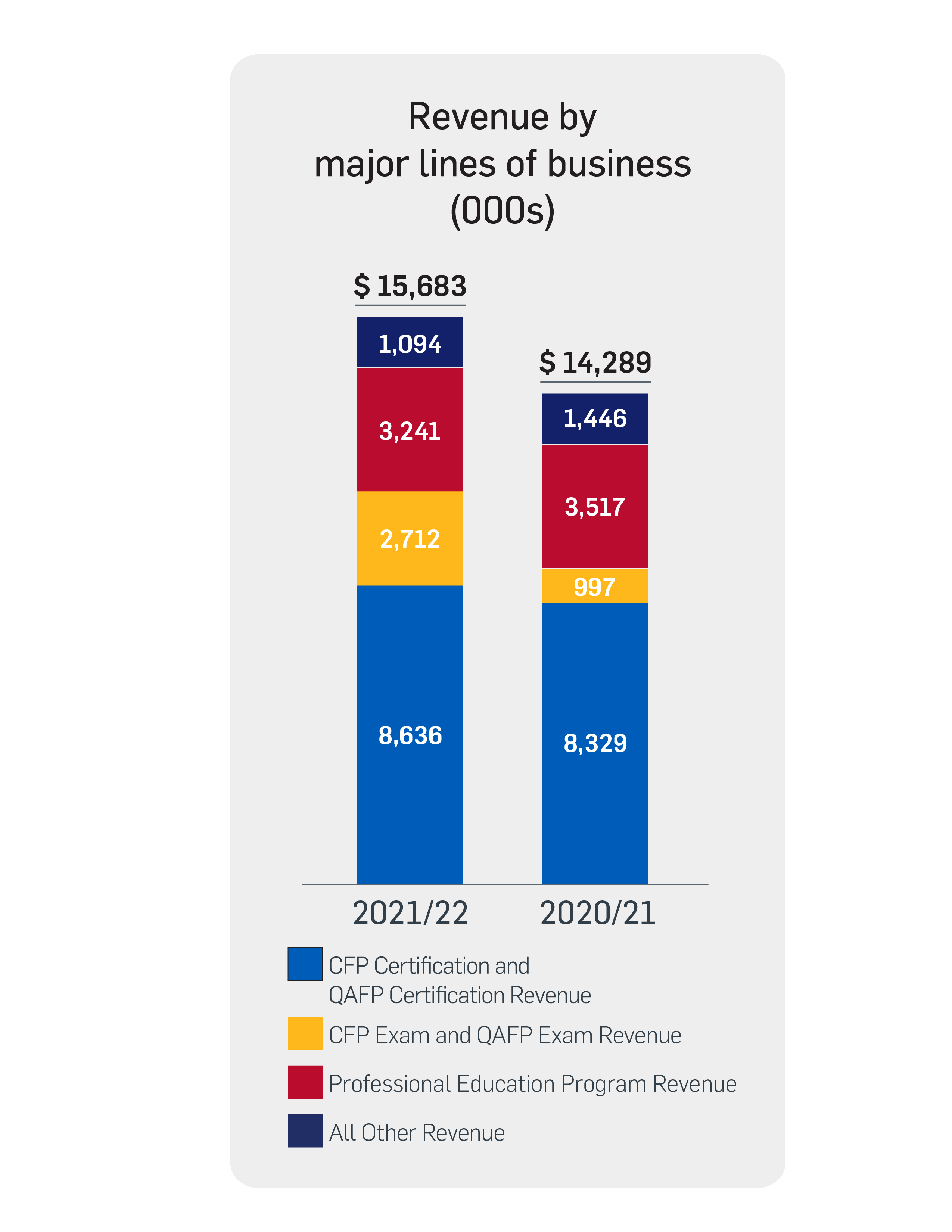

Revenue grew from $14.3 million in 2021 to $15.7 million in 2022, and comes primarily from certification fees, examination fees and Professional Education Program fees. In 2022, FP Canada earned $8.6 million in certification fees, representing 55% of total revenue, compared to $8.3 million in 2021, or 58% of total revenue. FP Canada earned another $3.2 million from Professional Education Program fees, compared with $3.5 million in 2021. FP Canada also earned $2.7 million from examination fees, compared with $1.0 million in 2021. This increase is attributed to offering three exam administrations in fiscal 2022 compared to only one administration in fiscal 2021.

Expenses before amortization increased from $11.6 million in 2021 to $13.2 million in 2022.

FP Canada continued to mitigate the impact from the global pandemic by adapting several business processes, including holding its annual conference during Financial Planning Week as a virtual event and offering online-proctoring as an alternative to in-person examinations.

Revenue grew from $14.3 million in 2021 to $15.7 million in 2022, and comes primarily from certification fees, examination fees and Professional Education Program fees. In 2022, FP Canada earned $8.6 million in certification fees, representing 55% of total revenue, compared to $8.3 million in 2021, or 58% of total revenue. FP Canada earned another $3.2 million from Professional Education Program fees, compared with $3.5 million in 2021. FP Canada also earned $2.7 million from examination fees, compared with $1.0 million in 2021. This increase is attributed to offering three exam administrations in fiscal 2022 compared to only one administration in fiscal 2021.

Expenses before amortization increased from $11.6 million in 2021 to $13.2 million in 2022.

FP Canada continued to mitigate the impact from the global pandemic by adapting several business processes, including holding its annual conference during Financial Planning Week as a virtual event and offering online-proctoring as an alternative to in-person examinations.