FINANCIAL PLANNING AS A CAREER

The financial planning profession directly contributes to the wellbeing of society. Financial planners are trusted partners through all phases of their clients’ lives. They help clients manage their everyday and complex financial needs with a plan that fits their whole lives and changing circumstances. Financial planners’ ongoing guidance helps their clients build financial confidence.

Financial planners must have comprehensive financial planning technical skills and knowledge to offer professional advice. Just as importantly, they need strong behavioural and relationship skills so they can communicate and connect effectively with their clients.

To raise awareness about financial planning as a career, FP Canada works with its industry and education partners to describe the options and communicate the pathways to become a financial planner.

- Complete the comprehensive technical requirements and the professional education program

- Pass the certification exam

- Demonstrate relevant work experience

- Commit to ongoing professional development

- Adhere to a strict code of ethics

PROMOTING PROFESSIONAL FINANCIAL PLANNING TO CANADIANS

- Find a Planner Tool – to locate a professional financial planner in a specific area or verify a planner’s certification status

- Financial Planning for Canadians website – a stand-alone site with articles, videos, infographics and more

- The FP Canada consumer e-newsletter – ongoing tips and guidance from professional financial planners for life stages and life events.

- Social media – news updates and timely information such as FP Canada’s COVID-19 resources

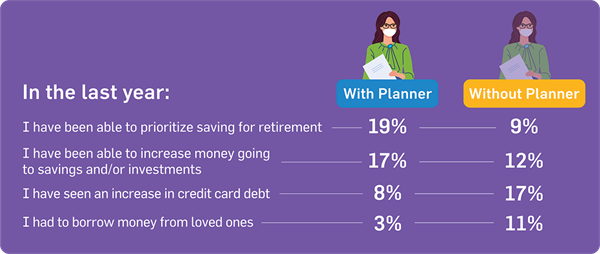

Consumer research provides insights on the benefits of financial planning

The unprecedented disruption of the pandemic showed that, more than ever, Canadians need personalized, professional financial planning advice to navigate financial challenges. The Tale of Two Pandemics survey found that people who work with professional financial planners were more able to adapt to the impact of COVID-19.

FINANCIAL PLANNING WEEK

- 1,754 attendees participated from across Canada – 30% for the first time

- 85% were CFP professionals or QAFP professionals

- 88% of attendees said they would recommend the event

PRESIDENT'S LIST

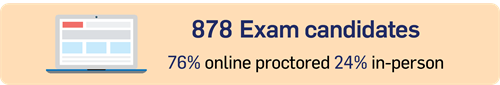

This prestigious list honours CFP exam candidates with the highest scores across Canada.

Rory Drennen

Ottawa, ON

1st Place

Jarrett Holmes

Winnipeg, MB

2nd Place

Kristopher Kibler

Calgary, AB

3rd Place

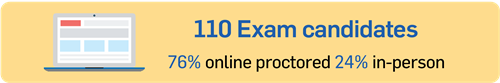

QAFP EXAM AWARD OF MERIT

The newly instituted award is conferred on the candidate receiving the highest mark on the QAFP exam across Canada.

Nicole Robyn

Hamilton, ON

Larry A. Wood, CFP®

2020 DONALD J. JOHNSTON LIFETIME ACHIEVEMENT AWARD

The Donald J. Johnston Lifetime Achievement Award in Financial Planning recognizes a lifetime of contribution to, and a lasting positive impact on the financial planning profession. Award candidates are nominated by their peers, and recipients are selected

by an independent committee.

Larry A. Wood, CFP® is a tenured professor at the University of Calgary’s Haskayne School of Business , where he teaches corporate governance, ethical decision making and personal finance management. He was instrumental in establishing the FP Canada-approved education program at the University of Calgary and has educated hundreds of students who have become financial planners.

Mr. Wood has authored numerous academic papers and textbooks, and also has extensive experience in helping some of Canada’s biggest financial services firms shift from a product focus to comprehensive financial planning. An FP CanadaTM Fellow since 2011, he has also participated in the ongoing development of global standards for Certified Financial Planner® professionals.

FP CANADA FOUNDATION RESEARCH AND RESOURCES

The FP Canada Research Foundation™ is an independent registered charity dedicated to funding financial planning research to enhance the wellbeing of all Canadians. The Foundation funds, promotes and disseminates research to financial planners to enhance their practice, as well as to academic partners and consumers.

The Foundation provides funding for:

- technical research that examines current practices in financial planning and provides evidence for financial planning strategies and decision-making models to help financial planners provide informed and effective advice to their clients

- behavioural research that examines the impact of human behaviour on effective financial planning

- societal research that examines the benefits of financial planning for society as a whole.