FINANCIAL POSITION

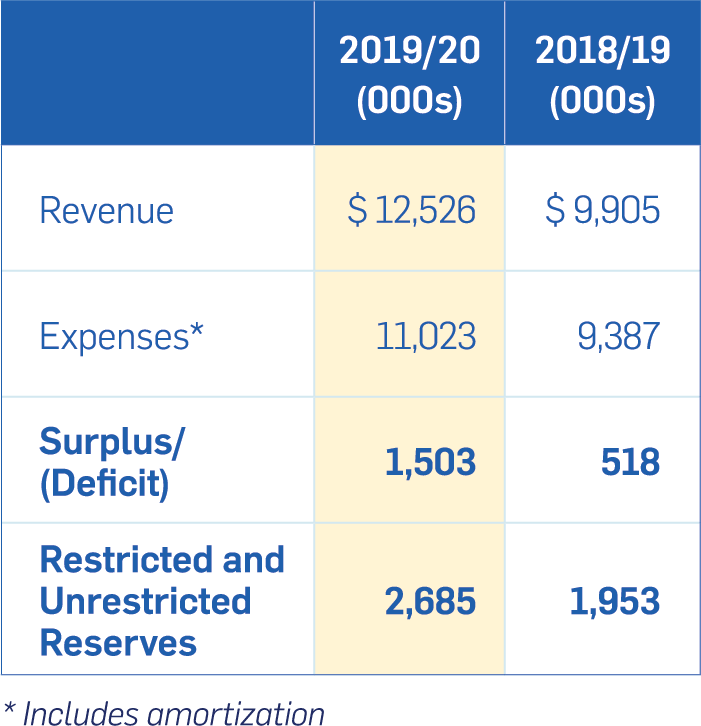

At March 31, 2020, FP Canada’s net assets are $5.6 million, compared to $4.1 million in 2019. Internally restricted and unrestricted net assets are $2.7 million, compared to $2.0 million in 2019. To mitigate risk of unforeseen circumstances, FP Canada targets holding internally restricted and unrestricted net assets equal to six months’ operating expenses. Current surpluses account for less than three months’ operating expenses, as FP Canada has invested the vast majority of its accumulated surplus in recent years in new program development and infrastructure upgrades.

FP Canada’s cash, cash equivalents and investments total $13.7 million at March 31, 2020, compared to $11.9 million in 2019. Short- and long-term investments are invested in accordance with the Board approved investment policies and managed by external fund managers.

Capital expenditures in 2019/20 were $1.1 million, compared with $1.2 million in 2019, and relate mostly to development costs for the Professional Education Programs.