Ontario Title Protection Legislation

The Financial Professionals

Title Protection Act, 2019

On March 28, 2022, the Financial Professionals Title Protection Act was proclaimed into force in Ontario.

This legislation creates minimum standards for individuals using the Financial Planner and Financial Advisor titles, so that consumers can have confidence that the individual they are dealing with has a minimum standard of education, is being actively supervised by an approved credentialing body, and is subject to ethics requirements and a complaints and discipline process.

Only individuals who hold a credential that has been approved by FSRA as a Financial Planner credential may use the Financial Planner title (or a restricted variation), and only individuals who hold a credential that has been approved by FSRA as a Financial Advisor credential may use the Financial Advisor title (or a restricted variation).

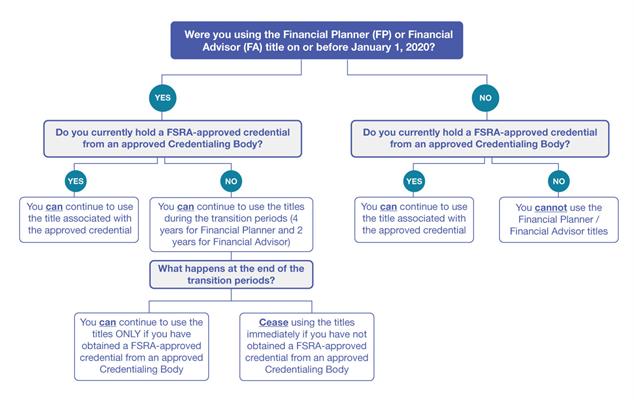

As part of the implementation of this legislation, FSRA introduced a set of transition rules, which may continue to impact some professionals. The rules can be found on the FSRA website.

FP Canada™ is an Approved Credentialing Body

FP Canada is approved by FSRA as a credentialing body under the framework, and both CFP® certification and QAFP® certification are approved as Financial Planner credentials for use of the Financial Planner title.

Canadians who work with CFP professionals and QAFP professionals have the confidence of knowing their financial planners have demonstrated the knowledge, skills, experience, and ethics to provide the holistic financial planning advice they need.

This page provides details on what this legislation means for CFP professionals, QAFP professionals, aspiring financial planners, consumers, and other industry partners.

Resources

Learn more about the Financial Professionals Title Protection Rule and related guidance on FSRA’s website

FSRA released a set of transition rules when the title protection legislation was implemented. Learn more them on FSRA’s website

Read FSRA’S Backgrounder: Financial Professional Title Protection in Ontario (fsrao.ca)

Learn more about becoming a financial planner

Quick Facts

- WHO is affected? CFP professionals and QAFP professionals who reside or conduct business in Ontario

- WHAT does title protection do? Regulates the Financial Planner and Financial Advisor titles, and certain variations, and their use in Ontario

- WHEN are the key dates to know? The coming into force date was March 28, 2022. FP Canada received FSRA approval as a credentialing body, and CFP certification and QAFP certification received approval as Financial Planner credentials, on April 11, 2022.

Frequently Asked Questions

1. As a CFP professional/QAFP professional, what does FSRA’s approval of FP Canada as a credentialing body, and approval of CFP certification and QAFP certification as Financial Planner credentials, mean to me?

In accordance with the Financial Professionals Title Protection Act, only individuals who hold an approved credential from an approved credentialing body are permitted to use the titles associated with the approved credential (either a Financial Planner or Financial Advisor credential).

FP Canada has been approved by FSRA as a credentialing body, and both CFP certification and QAFP certification have been approved by FSRA as Financial Planner credentials.

Accordingly, all CFP professionals and QAFP professionals are permitted to use the newly regulated “Financial Planner” title and any of the following “restricted variations” of the Financial Planner title, which have likewise been restricted by FSRA to individuals who hold an approved Financial Planner credential:

- Any variation in spelling or abbreviation of Financial Planner (e.g. FP)

- ________ Financial Planner (e.g. Senior Financial Planner, Qualified Financial Planner, etc.)

- Financial ________Planner (e.g. Financial Wealth Planner, Financial Investments Planner, etc.)

- Financial Planner _________ (e.g. Financial Planner Investments)

- Financial Planning _________ (Advisor, Adviser, Coach, Consultant, Counsellor, Guru, Manager, etc.)

- Any variation of the above titles in another language

2. How do CFP professionals/QAFP professionals know if they fall under the new FSRA title protection framework?

FSRA has asserted that all credential holders with a “nexus to Ontario” are included in the scope of the title protection framework. Working with FSRA for clarity purposes, a “nexus to Ontario” can be considered to exist if the credential holder:

- Is principally resident in Ontario

- Has an office or other place of business in Ontario

- Provides financial planning and advising services to clients in Ontario

- Holds out to consumers in Ontario that they are a credential holder, regardless of whether the credential holder has a direct or indirect presence in Ontario. An indirect presence in Ontario includes communicating with actual or potential Ontario clients via mail, telephone, email or any other method.

3. As a CFP professional/QAFP professional, am I now required to use the Financial Planner title (or a restricted variation)?

No. The Financial Professionals Title Protection Act regulates who has permission to use the titles Financial Planner and Financial Advisor; it does not compel their use. Therefore, just because you hold an approved Financial Planner credential (i.e. CFP certification or QAFP certification), it does not mean you must use that corresponding title.

As consumer awareness of this regulation continues to grow, CFP professionals and QAFP professionals are encouraged to use the regulated titles to make it easier for consumers to identify that credential holders have demonstrated the necessary knowledge, skills, experience, and ethics to provide holistic financial planning advice.

4. As a CFP professional/QAFP professional who currently uses the title Financial Planner (or a restricted variation), is there anything I need to do as a result of FSRA’s title protection framework?

No. Provided you maintain your CFP certification or QAFP certification in good standing, you do not need to take any action as a result of FSRA’s title protection framework.

5. As a CFP professional/QAFP professional, can I also use the Financial Advisor title?

No. CFP certification and QAFP certification have been approved as Financial Planner credentials.

Only individuals who hold an approved Financial Advisor credential may use the Financial Advisor title, or one of the following restricted variations of the Financial Advisor title:

- Any variation of spelling or abbreviation of Financial Advisor (e.g. Financial Adviser, FA)

- ________ Financial Advisor (e.g. Senior Financial Advisor, Qualified Financial Advisor, etc.)

- Financial ________Advisor/Adviser (e.g. Financial Wealth Advisor/Adviser, Financial Investments Advisor/Adviser, etc.)

- Financial Advisor _________ (e.g. Financial Advisor Investments)

- Financial Advising ________ (Coach, Consultant, Counsellor, Guru, Manager, etc.)

- Any variation of the above titles in another language

Therefore, unless you also hold a credential that has been approved by FSRA as a Financial Advisor credential, you cannot use the Financial Advisor title (or a restricted variation).

6. As a CFP professional/QAFP professional who currently uses the Financial Advisor title (or a restricted variation), what do I need to do as a result of FSRA’s title protection framework?

Unless you also hold a credential that has been approved by FSRA as a Financial Advisor credential, you will need to change your title, in accordance with FSRA’s transition rules.

Per FSRA’s transition rules, if you are a CFP professional or QAFP professional who was using the Financial Advisor title (or a restricted variation) on or before January 1, 2020, you may continue to use that title for two years from the date the legislation came into force (March 28, 2022). After that, you will either need to obtain a FSRA-approved Financial Advisor credential to continue using the title, or change your title to Financial Planner or another title that is not restricted by FSRA’s title protection framework.

Per FSRA’s transition rules, if you are a CFP professional or QAFP professional who started using the Financial Advisor title after January 1, 2020, you are only permitted to use the title once you hold an approved designation or license from a FSRA-approved credentialing body. You may change your title to Financial Planner or another title that is not restricted by FSRA’s title protection framework.

7. As a CFP professional/QAFP professional who is not using either of the Financial Planner or Financial Advisor titles (or a restricted variation of either), what do I need to do as a result of FSRA’s title protection framework?

The Financial Professionals Title Protection Act, specifically restricts the Financial Planner and Financial Advisor titles (and the variations of each identified above). The Act does not restrict the use of any other titles. Therefore, anyone using any other title is not required to change that title or take any other action as a result of FSRA’s title protection framework.

CFP professionals and QAFP professionals may wish to voluntarily switch to using the regulated Financial Planner title to communicate their qualifications to consumers and validate their education and expertise.

8. I am a student/candidate on the path to CFP certification/QAFP certification who wants to use the Financial Planner title. How does this change affect me?

Once you obtain your CFP certification or QAFP certification you will immediately be permitted to use the Financial Planner title (or a restricted variation).

Until then, FSRA has set transition rules for the new framework that include rules for individuals who do not yet hold an approved Financial Planner credential the core elements of which are as follows:

- If you do not hold a Financial Planner credential, but were using the Financial Planner title (or a restricted variation) on or before January 1, 2020, you may continue to use the title for four years from the date the legislation came into force (March 28, 2022). After that, if you have not obtained your certification, you will no longer be permitted to use the Financial Planner title.

- If you do not hold a Financial Planner credential, and you were not using the Financial Planner title (or a restricted variation) on or before January 1, 2020, you are required to change your title effective immediately to another title that is not restricted by FSRA’s title protection framework.

9. Where can I find more information on the transition requirements?

FSRA has published a dedicated page for transition information online: www.fsrao.ca/industry/financial-planners-and-financial-advisors/transition

FSRA has also created the following transition chart to help practitioners understand the implementation of the new framework:

FP Canada has also developed the following scenarios to help you understand the implementation of the new framework.

Transition Scenarios for CFP Professionals and QAFP Professionals

- Action Required to Comply with the Framework: None. You may continue to use your Financial Planner title (or a restricted variation) as long as you maintain your certification in good standing.

- Action Required to Comply with the Framework: Unless you hold an approved Financial Advisor credential, one of the following may apply:

- If you started using the title on or before January 1, 2020, you may continue using your title until March 28, 2024.

- If you started using the title after January 1, 2020, you are only permitted to do so once you have obtained an approved Financial Advisor credential from a FSRA-approved credentialing body. You may alternatively use the Financial Planner title or any other title not restricted by FSRA’s title protection framework.

- Action Required to Comply with the Framework: None. The title protection framework speaks only to the use of the titles Financial Planner and Financial Advisor, and their restricted variations.

- Action Required to Comply with the Framework: None. Regardlessof whether you work directly with clients, the title protection framework affords you permission to use the Financial Planner title (and restricted variations) because you are a CFP professional or QAFP professional. You are not required to use them, however.

Transition Scenarios for Students and Candidates on the Path to CFP Certification or QAFP Certification

- Scenario 1: I am a student or candidate on the path to certification and currently use the Financial Planner title (or a restricted variation).

- Action Required to Comply with the Framework: FSRA has developed transition rules for individuals currently working to obtain their Financial Planner credential:

- If you started using the title on or before January 1, 2020, you may continue using your title until March 28, 2026.

- If you started using the title after January 1, 2020, you are only permitted to do so once you have obtained an approved Financial Planner credential from a FSRA-approved credentialing body. You may use any other title not restricted by FSRA’s title protection framework.

- If you are successful in obtaining your CFP certification or QAFP certification, you are permitted to use the regulated Financial Planner title and any of the previously identified restricted variations of the Financial Planner title, which have likewise been restricted by FSRA to individuals who hold an approved Financial Planner credential.

- Scenario 2: I am a student or candidate on the path to certification and currently use the Financial Advisor title (or a restricted variation).

- Action Required to Comply with the Framework: Unless you hold an approved Financial Advisor credential, one of the following may apply:

- If you started using the title on or before January 1, 2020, you may continue using your title until March 28, 2024.

- If you started using the title after January 1, 2020, you are only permitted to do so once you hold an approved Financial Advisor credential from a FSRA-approved credentialing body. You may use any other title not restricted by FSRA’s title protection framework.

- Scenario 3: I am a student or candidate on the path to certification and currently use a title other than Financial Planner, Financial Advisor, or a restricted variation of either.

- Action Required to Comply with the Framework: You may continue to use your title in accordance with FSRA’s title protection framework.

10. Are abbreviations or translations of the Financial Planner title permitted?

Yes. Individuals who hold an approved credential are permitted to use abbreviations and translations in French and other languages of the Financial Planner title.

11. My title is set by my employer. They do not use any of the Financial Planner titles outlined by FSRA for use with my credential. What do I do if I want to use one of the approved Financial Planner title(s)?

The Financial Professionals Title Protection Act, regulates who has permission to use the Financial Planner and Financial Advisor titles; it does not compel their use.

Therefore, while employers may wish to embrace these titles given the value to consumers, they are not required to use these titles, or allow their use internally.

Going forward, FP Canada will work diligently to promote the value of the Financial Planner title to industry firms for the benefit of consumer clarity.

12. Is there a fee associated with this oversight framework?

Similar to other sectors regulated by FSRA, costs associated with FSRA’s regulatory oversight of the financial professionals sector must be recovered from the regulated sector. Accordingly, there is a mandatory fee to cover FSRA’s oversight that will be passed on to credential holders. The financial professionals fee structure has been designed based on the estimated resources required to fulfill FSRA’s regulatory requirements under the Financial Professionals Title Protection Act.

FSRA has published a Fee Rule detailing assessments and fees associated with the title protection framework. Please learn more by visiting the FSRA Fee Rule.

13. What are the fees associated with this framework?

In accordance with the FSRA Fee Rule, FSRA uses a variable fee formula to calculate sector costs on an annual basis. These costs must be recovered wholly from the regulated sector. As such, fees will fluctuate from year to year based on FSRA’s oversight costs and expenditures for that year, and the pool of active credentialing bodies and credential holders that can be assessed for cost recovery purposes.

The FSRA fee FP Canada collects and remits from credential holders to FSRA is set based on the annual assessment FP Canada receives from FSRA.

14. What is the new FSRA public registry?

As part of its oversight and administration of the Financial Professionals Title Protection Act, FSRA has committed to establishing a public registry of all individuals approved for use of the Financial Planner or Financial Advisor titles in Ontario.

The registry is intended to assist consumers in verifying that the financial advisor or financial planner they are considering or already working with holds an approved credential. The credentialing body from which the planner or advisor’s credential was obtained will also be displayed, and links to additional information on credential holders (which will be maintained by approved credentialing bodies) may also be available.

15. Can I opt out of displaying my information on the FSRA Registry?

FSRA requires that all credential holders with a “nexus to Ontario” appear in the public registry.

For all CFP professionals and QAFP professionals who are subject to the title protection framework, FP Canada is required to share the following information with FSRA, which will, in turn, be displayed on the FSRA public registry:

- Your legal name

- Your certification (i.e., CFP certification or QAFP certification)

- Your certification status

- The date your certification was obtained

- Your employer (if any)

- Your business address (if any)

- Your disciplinary history with FP Canada (if any)

- Your business email (note: your email will not be displayed publicly on the FSRA registry)