So, you’re interested in a career in financial planning?

Excellent choice.

Join an in-demand profession that directly contributes to the wellbeing of society. Professional financial planners help manage their clients’ everyday and complex financial needs to help them achieve their goals through a plan that fits their diverse and changing circumstances. Your ongoing guidance will help build your clients’ financial confidence.

Successful financial planners are trusted partners through all phases of their clients' lives.

Help all Canadians achieve financial wellness. Imagine the difference you can make!

FP Canada™ offers two professional financial planning certifications: Certified Financial Planner® certification and Qualified Associate Financial Planner™ certification.

“It’s a relationship business. You think it’s about money, but it’s really about helping to make a difference for people in a holistic way“

What do financial planners really do?

As a professional financial planner, you will:

- Listen closely to your clients, help them identify their aspirations and goals

- Work with them to develop a financial plan that addresses and reflects their whole lives and circumstances

- Partner with your clients to implement the plan and continue to evolve the plan to fit your clients’ changing circumstances

As professional financial planners, you must be able to focus on all aspects of your clients' lives and see their needs through a holistic lens. Plus, you will need to understand the behavioural factors that drive their decisions while working with the highest standards of professional responsibility.

FP Canada has termed this approach "3H Financial Planning" - Human, Holistic and Honest.

“My job is about building relationships. My biggest satisfaction is when my clients say, ’I trust you with my money.’ It’s all about building on that trust.“

Financial Planners provide professional advice in the following key areas:

- Financial Management

- Insurance and Risk Management

- Investment Planning

- Retirement Planning

- Tax Planning

- Estate Planning and Legal Aspects

Is this the right career choice for you?

- ✓ Do you enjoy working with people?

- ✓ Are you focused and goal-oriented?

- ✓ Do you enjoy problem-solving?

- ✓ Are you a good listener?

- ✓ Can you ask difficult, sometimes uncomfortable questions?

- ✓ Is contributing to the community important to you?

“My financial planner helps me make sense of the noise. There are so many people out there talking about money but she helps me make sense of it, so that I know what I need to know to make good decisions.“

Why must you certify?

Certification is important because:

- Knowledge and Skills: Confirms you have the knowledge, skills, and experience to provide financial advice

- Professional Responsibility: Shows your commitment to the highest ethical standards

- Professional Brand: Demonstrates your value to employers and clients

- Regulatory Requirements: Ensures you keep pace with evolving legal and regulatory requirements

- Trust: Fosters trust in the advice clients get from you

“The certification material upped my game and level of knowledge. I can now suggest more solutions for my clients and ask some difficult questions. Instead of focusing on one need, I’m able to see a bigger picture for their financial plan.“

FP Canada Certifications

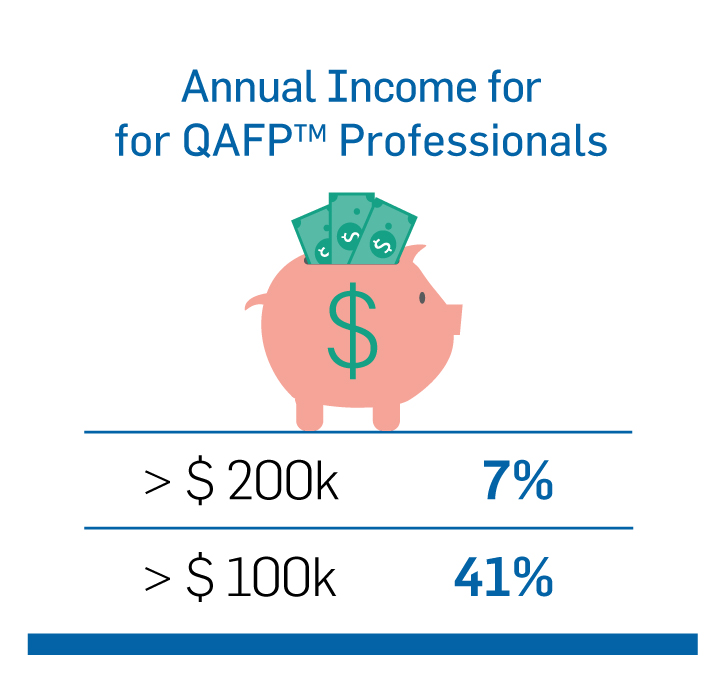

Qualified Associate Financial Planner™ Certification

QAFP® certification is a great way to start your career in financial planning. Offered by FP Canada, this certification provides a quicker path to becoming a professional financial planner, and it can be a stepping stone to earning your CFP certification. With a QAFP designation, you will be ideally suited to help clients who want to grow their financial well-being. Your advice will be holistic and touch many aspects of each client’s life. QAFP professionals serve a diverse population by offering advice for today's speed of life.

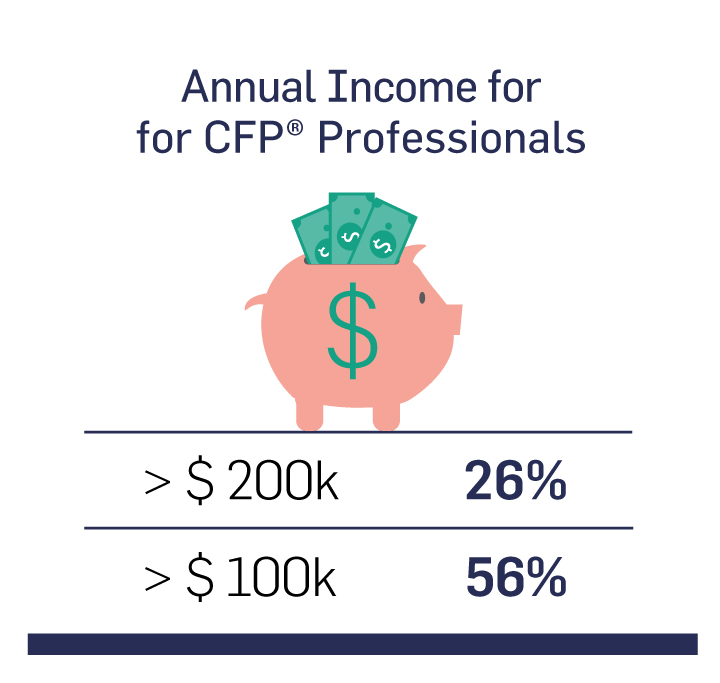

Certified Financial Planner® Certification

CFP® certification is the world’s most recognized financial planning designation and is considered the ‘gold standard’ for the profession. CFP professionals see their clients’ entire financial picture, no matter how complex, and work together to build a comprehensive financial plan so they can Live Life Confidently™.

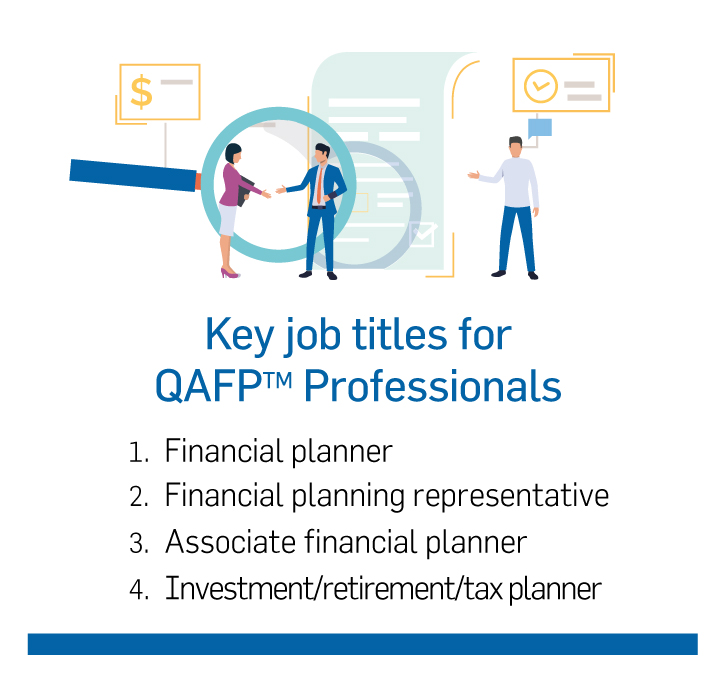

Your Future and Employment Opportunities

Financial planners are highly sought-after and have a diverse range of professional opportunities, including:

- Retail banking

- Wealth management

- Boutique financial services firms, or as

- Independent professionals

A day in the life of a financial planner

Wonder what a day in the life of a professional financial planner looks like?

QAFP® Professional

Sun Life Advisor Cambria Financial Solutions, Inc. BC

"The best part is when I hear a client tell me they’ve saved enough to buy a home. I know I’ve helped them achieve that dream, in a tough market."

CFP® Professional

DLD Financial, BC

"It’s really about how to make someone’s life better, and to make them feel better about what’s going to happen in the future."