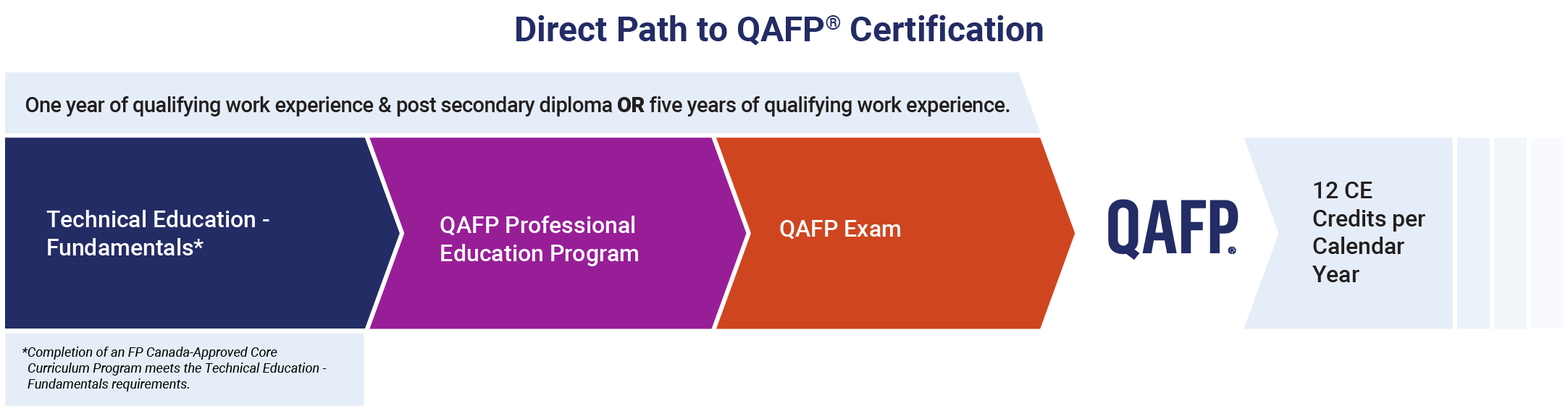

Direct Path to QAFP® Certification

Qualified Associate Financial Planner™ certification is designed for a new era of financial planning, helping professionals acquire the knowledge and skills they need, all informed by high ethical standards. QAFP professionals have demonstrated the competency to guide the financial well-being of a new generation of wealth builders.

The path to QAFP certification is structured to create proficiency sooner with new learning options and improved alignment between technical education and professional relationship development. Upon certification, QAFP professionals will have confidence in their capacity to provide holistic financial advice for today's speed of life.

To obtain QAFP certification, candidates must complete a comprehensive education program, pass a national exam, have a post-secondary diploma and demonstrate one year of qualifying work experience. To maintain certification, QAFP professionals must keep their knowledge and skills current by completing 12 hours of continuing education each year, including at least one hour of professional responsibility focused continuing education. They must also adhere to the FP Canada Standards Council™ Standards of Professional Responsibility, including a Code of Ethics which requires that QAFP professionals place their clients' interests first. The Standards Council vigilantly enforces these standards. For more information, refer to the QAFP Certification Policies.

Explore the steps below or click the diagram on the right to learn more.

4 Steps to QAFP Certification

Technical Education – Fundamentals

Enrol in and complete FP Canada Institute™ Technical Education – Fundamentals or an FP Canada-Approved Core Curriculum Program.

Learn more about the Education Requirements

QAFP Professional Education Program

Enrol in and complete the QAFP Professional Education Program which now includes the Introduction to Professional Ethics course content.

Learn more about the QAFP Professional Education Program

QAFP Exam

Register for and write the four-hour, computer-based exam consisting of both stand-alone and case-based multiple-choice questions. The exam focuses on specific elements of the FP Canada Standards Council™ Competency Profile

and integrates several financial planning areas.

Learn more about the QAFP examination

Helpful Resources

QAFP Exam Study Toolkit

Apply for QAFP Certification

Once you have completed one year of qualifying work experience, you are ready to apply for QAFP certification.

Note: Applicants for QAFP certification must hold a minimum two-year diploma from an accredited Canadian post-secondary institution, or an international equivalent or have five years of qualifying

work experience.

Learn more about work experience requirements

Learn more about post-secondary education requirements