Frequently Asked Questions

What is the Financial Planning Body of Knowledge (FP-BoK)?

The first of its kind internationally, the FP-BoK is an authoritative compendium of all the detailed knowledge expected of QAFP professionals and CFP professionals in Canada. It serves to further define the competencies expected of those who hold either certification, and the differences between the two.

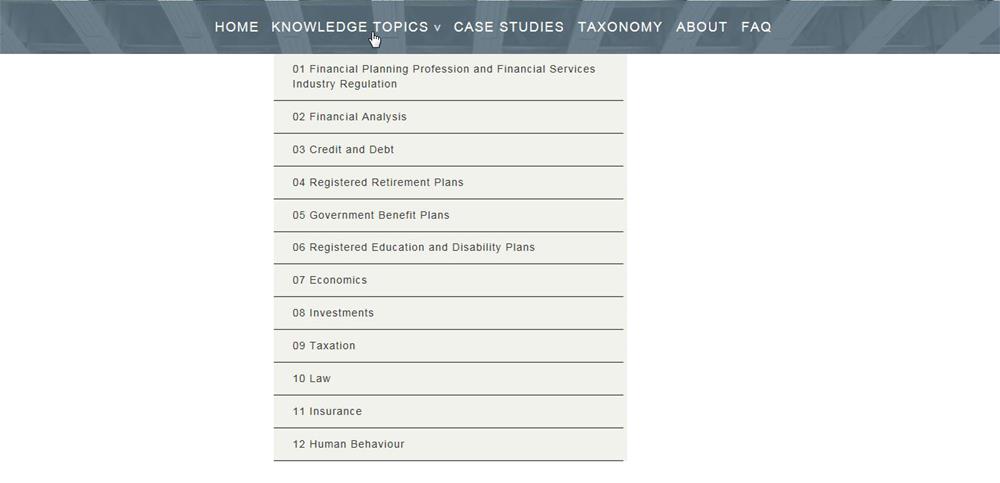

Comprising 12 knowledge topics with accompanying case studies that illustrate the application of knowledge in each topic, the FP-BoK describes in detail the knowledge expected of financial planning professionals in all financial planning areas.

Why is the FP-BoK important?

The FP-BoK lays the foundation for more clearly defined and more consistent delivery of financial planning throughout the profession. It explicitly outlines the knowledge and competencies that should be expected from QAFP professionals and CFP professionals, for the benefit of the Canadian public, educators, students,industry firms and financial planning professionals.

The FP-BoK builds on the Canadian Financial Planning Definitions, Standards & Competencies, published in 2015, to define the scope and holistic nature of financial planning. The FP-BoK also provides the underpinning for the FP Canada Standards Council™ Competency Profile—it is essential to the demonstration of competence in the fundamental financial planning practices, financial planning areas, and professional skills.

How do the knowledge expectations for QAFP professionals and CFP professionals differ?

While both certifications draw from the same Body of Knowledge, the knowledge expectations for CFP professionals are broader, given that they must provide objective financial planning advice at the highest level of complexity required of the profession. Specifically, CFP professionals are expected to have greater depth of knowledge in areas including registered retirement plans, registered education and disability plans, taxation, insurance, and estate planning and legal aspects. View the areas where CFP professionals are expected to have a greater depth of knowledge.

How was the FP-BoK developed?

FP Canada thanks the many pioneers who contributed to this initial publication. The FP-BoK was developed by experts from throughout the financial planning profession and related fields, including more than 80 practicing CFP professionals from across Canada. It underwent a rigorous review process—including input by CFP professionals, educators and a special Working Group—to ensure its relevance, clarity, comprehensiveness and currency.

How can the FP-BoK help me?

- If you are an educator, the detailed knowledge expectations of QAFP professionals and CFP professionals described by the FP-BoK will provide you with the clarity to develop and deliver educational content that prepares the next generation of financial planners.

- If you are a student pursuing a career in financial planning, the FP-BoK can help you understand the distinct nature of financial planning, as defined by the expectations of QAFP professionals and CFP professionals, when compared with other disciplines. It will help you to better understand the knowledge you will be required to apply as a competent financial planning professional.

- If you are a leader within a financial industry firm, the FP-BoK provides explicit, specific details about the knowledge expectations of QAFP professionals and CFP professionals that will aid you in recruiting and managing financial planning professionals to meet the broad, holistic financial planning needs of clients.

- If you are a CFP professional, the FP-BoK defines the knowledge and competencies that you are expected to maintain in order to meet your clients’ and employer’s expectations. The FP-BoK details the broad knowledge you must possess to capably provide the highest level of objective financial planning advice, as compared to those working with clients with less complex financial planning needs. Among the areas where you are expected to have greater depth of knowledge are registered retirement plans, registered education and disability plans, taxation, insurance, and estate planning and legal aspects.

- If you are a QAFP professional, the FP-BoK defines the knowledge and competencies that are expected of you at this level of certification, assisting you in maintaining currency of knowledge and meeting your clients’ and employer’s expectations.

- If you are a member of the public, the FP-BoK can help guide your decision about the value of working with a qualified financial planning professional for advice around your financial planning needs.

How can I use the FP BoK?

The FP-BoK is made up of 12 knowledge topics. You can use the top navigation menu to explore statements that describe the knowledge expectations of QAFP professionals and CFP professionals in each topic.

You can also access case studies that illustrate the application of knowledge for each topic and reflect the expected differences in the complexity of scenarios that a QAFP professional or CFP professional may face in

practice.

You can also access case studies that illustrate the application of knowledge for each topic and reflect the expected differences in the complexity of scenarios that a QAFP professional or CFP professional may face in

practice.

How will the FP-BoK be kept current?

The currency of the FP-BoK will be maintained with input from CFP professionals.

Is there a hard copy or printed version of the FP-BoK?

While developing the FP-BoK, much thought was put into its format and delivery. Financial Planning is an ever-evolving profession, and by maintaining an online version of the FP-BoK only, FP Canada ensures that all stakeholders are accessing the most up-to-date content. The FP-BoK also contains links to external sites that may be periodically updated to ensure current material is referenced.